8 Business terms you should know already

5 minuteRead

Well, we live in a world of business and business terms. We see them all around us, we hear them on the radio and we read about them in the newspaper. It's hard to know which words are important and which ones are just jargon. The modern world is becoming increasingly complicated. With its current pace of growth, more changes are happening in the world today than ever before. Understanding business terms has never been more important to ensure that you're on top of your game.

Business terms can be used to communicate what you want to say quickly, accurately, and succinctly. When you know the right phrases for the right situation, it gives you a competitive edge over those who don't. It will help you to be more successful and professional in your work. Understanding and using the right term can also save you time and money by avoiding miscommunications that could cost you a lot of time or money. Here all business terms you should be aware of.

Here's a video for you to get familiarised with Business /financial terms.

1. Liabilities

Liabilities are any obligations owed by your firms, such as bank loans, mortgages, unpaid invoices, IOUs, or any other quantity of money owed to someone else. In accounting, liabilities are a company's financial commitments, such as money owed to suppliers, salaries payable, and loans owed, and may be seen on a company's balance sheet. In other words, liability is anything a person owes to another person.

It might be as simple as an overdue bill or as complex as a massive mortgage. Liability provisions are commonly included in contracts between business owners and their workers. It provides them with the authority to take action against a person or corporation if they are proven to have done something unlawful, immoral, or unfavourable to the firm. A credit increases an obligation in the accounting records, whereas a debit decreases it. If you committed to pay someone money in the future and haven't done so, you have a liability.

2. Line of Credit

A bank will generally provide short-term borrowing up to a certain amount. The debtor borrows up to the credit limit as needed without having to renegotiate the loan. A line of credit is generally given by lenders such as banks or credit unions, and if you qualify, you can draw on it for a defined period up to a maximum amount.

3. Gross Profit

The difference between what a firm spent on the manufacture of all its items and what it made in sales, also known as gross margin.

Gross profit on sales is calculated by subtracting all money spent (cost of items sold) from money made (net sales).

The term "gross profit" refers to the amount that shows on the income statement. The little firm had high enough gross revenues to invest more in development, allowing it to become a market participant far sooner than anyone imagined.

4. Marginal Cost

The marginal cost is the change in overall cost that occurs when the amount produced is increased. This is also known as the cost of producing more quantity. The marginal cost is the cost increase that happens when output is raised by one unit. In more technical terms, it is the output derivative of the total cost function. In certain circumstances, it refers to a one-unit increase in output, while in others, it relates to the rate of change in total cost when production volume increases by a minuscule amount.

5. Income Statement

A record of a company's earnings or losses for a specific period, usually a year, quarter, or month. Displays all income created by the firm during this period, such as earned (revenues) and all money spent (expenses). Also takes into account the impacts of several fundamental accounting concepts, such as depreciation. The income statement is critical for management since it serves as the primary measuring stick (metric) for profitability. The income statement gives stakeholders a lot of information about the company's operations, such as where the film spends most of its money, so they can compare a company's performance to prior years and see if the business is successful.

6. Depreciation

Depreciation is defined as the systematic reduction of a fixed asset's reported cost until the asset's value is zero or insignificant. Depreciation reduces taxable income while not reducing cash flow. The number of years over which you depreciate anything is determined by its useful life (how many years would that product/anything be completely useable). Depreciation is the gradual decrease in the monetary worth of a tangible object due to usage, wear and tear, or obsolescence. The only exception island, which cannot be depreciated since its value grows with time.

7. Advisory Board

A group of three to six outside specialists are frequently hired by entrepreneurs to offer regular advice and ideas to management.

An advisory board's role is to aid businesses with everything from marketing to human resource management to influencing the direction of regulators. Advisory boards are made up of experienced professionals who provide creative ideas and fresh insights. Boards of directors, which meet regularly or biannually, can give strategic direction, drive quality improvement, and review programme success.

8. Amortization

Amortization is the technique of spreading the expense of an intangible asset over its useful life. Intangible assets are not physical assets in and of themselves. When a mortgage payment is made, a portion of the payment is applied to the loan as interest, and the balance is applied to the principle. Also, there exists an amortisation schedule which is nothing a table that details each periodic payment on a loan, shows the amounts of principal and interest, and shows how the principal amount of a loan reduces over time.

Bonus

Bank Statement

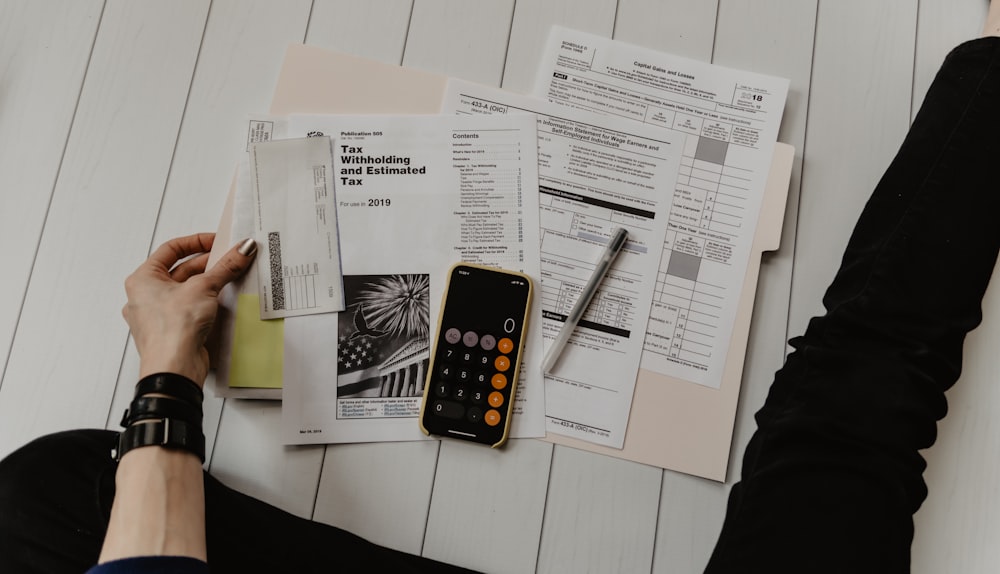

A bank statement, also known as an account statement, is a document produced by a bank that describes the actions in a depositor's savings or current account for a given time. In simple words, A record of a firm’s account that is regularly provided by the bank, either in print or online. Bank statements allow account holders to keep track of their transactions and accounts. They may also include other pertinent information for the account type, such as how much is due by a specific date. By reading your bank statements, you're improving your financial health and gaining control of your funds, bringing you closer to your financial objectives.

Write, Record and Answer! Consume Unlimited Content! All you need to do is sign in and its absolutely free!

Continue with one click!!By signing up, you agree to our Terms and Conditions and Privacy Policy.