All About Budgeting- Dos and Don'ts!

4 minuteRead

By Samyati Mohanty

It's necessary to create a budget in order to manage your finances. A few crucial guidelines should be followed when creating a budget. There are other things that must be avoided as well. Setting goals will help the difficult decisions that come with budgeting become a little bit simpler. You should define short, medium, and long-term goals and monitor your progress toward them as you create a budget. The following list of dos and don'ts for budgeting will assist you in creating an excellent personal budget for yourself:

What are the DOs for budgeting?

- Before creating a budget, assess your existing spending. Start by generating a list of all your expenses. Then calculate your monthly expenses based on your spending. You can more precisely estimate your expenses by doing an analysis of and making a list of your present spending. You can estimate how much you can invest and save for the future with its assistance.

- Do make reasonable goals. To set realistic goals, you must limit your expenditure to a level that is both realistic and achievable for you. Only by reviewing your revenue and expenses from the preceding months can this be accomplished. You can use it to produce accurate budget estimates.

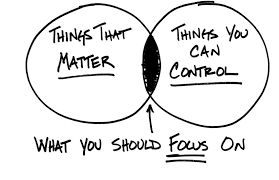

- Do be specific about and prioritise your financial objectives: Create a list of all your financial objectives before creating a budget. Financial objectives can take many different forms, including debt repayment, home ownership, family vacations, and more. Put your most critical goals first and allocate more funds to achieving them.

- Do distinguish between your requirements and wants: Maintaining a healthy financial life requires that you distinguish between your needs and wants. It is highly subjective and varies from person to person if a good or service is something you need or want. You should determine whether the items you are spending a lot of money on are necessities for you or just wants. After which, decide how you want to spend your money on the products and services.

- Do adhere to the budget and keep it updated: As I've previously stated in other articles, maintaining a budget is just as crucial as developing one. The second most crucial thing is to continuously adapt it to your current situation. Use the trial-and-error approach, which means to build a strategy, try it out, and, if it works for you, that's fantastic. But if it doesn't, adjust your plans in accordance with your requirements until you find the "optimal personal budget" for you.

What are the DON'Ts for budgeting?

- Don't create your budget according to your will and wishes: Don't do this. Make a budget that meets your needs by using a sound method.

- Don't be too hard on yourself: Setting up a budget and sticking to it will help you arrange your finances, but don't be too hard on yourself. Never hesitate to spend your money on the things you believe are essential for you.

- Don't forget to include unforeseen costs: If you don't set aside emergency funds for unforeseen costs, they could end up costing you a lot of money. Therefore, remember to include an additional column in your budget for emergency money.

- Avoid spending more than you make because doing so will result in massive debt accumulation. The impact on your financial situation will be negative. So, keep your spending inside your income range.

- Don't sit down and create a budget every day. It's important to update your budget frequently to reflect your current circumstances, but you shouldn't spend too much time deciding how to spend your money every day. Your time is just as valuable as your cash. You can create weekly budgets and then monitor them to make any necessary adjustments.

A budget is essentially a spending plan that shows how much money is coming in compared to how much is going out over a given period of time. The average budget is made for a complete month because many bills, including those for housing, utilities, subscriptions, and more, are due on a monthly basis.

Budgeting is crucial since it enables you to monitor your spending, keep track of your costs, and increase your savings. Budgeting can also assist you in getting out of debt, planning for emergencies, improving your financial decisions, and maintaining focus on your long-term financial objectives.

Write, Record and Answer! Consume Unlimited Content! All you need to do is sign in and its absolutely free!

Continue with one click!!By signing up, you agree to our Terms and Conditions and Privacy Policy.