Financial Management Strategies for New Women Entrepreneurs

5 minuteRead

Starting a business can be an exhilarating and empowering journey, especially for women entrepreneurs. However, one of the most crucial aspects of entrepreneurship is effective financial management. These strategies will help you build a strong financial foundation and navigate the often complex world of business finances with confidence.

Starting your own business is a powerful step towards financial independence and personal fulfillment. It's a journey filled with opportunities and challenges, and your financial management skills will play a pivotal role in your success. Entrepreneurial success hinges upon effective financial management. Regardless of your business's size or industry, sound financial management is the cornerstone of success. Let's explore some essential financial strategies that will help you thrive as a woman entrepreneur.

Setting Financial Goals

Creating a roadmap for financial success starts with identifying both short-term and long-term financial objectives. By setting specific and measurable goals, women entrepreneurs can track their progress and maintain focus. Prioritizing personal and business financial goals is equally important, as a balanced approach allows for overall financial stability.

Creating a Comprehensive Business Budget

To ensure sound financial management, it is vital to assess the current financial situation. This evaluation enables entrepreneurs to understand their starting point and make informed decisions. Estimating startup costs and ongoing expenses allows for more accurate budget planning. Allocating funds for marketing, operations, and growth ensures a well-rounded budget that considers all aspects of the business.

Financing Options for Women Entrepreneurs

Exploring current loans and grants specifically tailored to women-owned businesses can provide significant financial support. Additionally, considering alternative funding sources like crowdfunding or angel investors can expand the pool of available resources. However, it is essential to understand the pros and cons of equity financing, as it may involve giving up partial ownership or control of the business.

![]()

Building Emergency Funds and Cash Reserves

In business, surprises are inevitable. Establish an emergency fund, setting aside at least three to six months' worth of business expenses. This cushion will provide peace of mind and ensure that your business can weather unexpected storms.

![]()

Effective Cost Management

Identifying and controlling unnecessary expenses is pivotal in maintaining financial health. Women entrepreneurs should actively review expenses and prioritize cost-cutting measures. Negotiating better deals with suppliers and vendors can further optimize the budget. It is crucial to implement cost-saving strategies without compromising the quality of goods or services offered.

Tax Planning for Entrepreneurs

Understanding tax requirements and obligations is essential to avoid legal pitfalls. Seeking professional assistance in tax planning ensures accuracy and compliance. Entrepreneurs should familiarize themselves with tax benefits and deductions available specifically for business owners, maximizing their financial advantage.

Separating Personal and Business Finances

Advantages abound when maintaining separate bank accounts for personal and business use. This clear delineation allows entrepreneurs to accurately track business-related transactions and maintain transparency. Establishing proper bookkeeping and accounting records fosters financial organization and facilitates informed decision-making.

Building and Managing Credit

Establishing a strong credit history for the business paves the way for future financial opportunities. Utilizing credit wisely boosts business growth by providing access to capital. Monitoring and improving credit scores allow entrepreneurs to secure favorable financing options, further strengthening their financial position.

Creating a Long-Term Financial Plan

Beyond day-to-day operations, a long-term financial plan is indispensable for sustained success. Establishing retirement savings and investment strategies ensures financial security in the future. Planning for business expansion and diversification allows for scalability and adaptability. Entrepreneurs should also consider exit strategies and succession planning to ensure a smooth transition when the time comes.

Risk Management and Insurance

Identifying potential risks and vulnerabilities is essential in protecting the business. Choosing appropriate insurance policies provides a safety net against unforeseen events. Effective risk management includes contingency planning, minimizing financial risks and their potential impact.

Seeking Financial Education and Mentorship

Continuous learning in financial management is vital for women entrepreneurs. Seeking advice from experienced entrepreneurs or mentors can provide valuable insights and guidance. Participating in financial workshops and educational programs can help develop essential financial skills and enhance overall business acumen.

Balancing Business and Personal Financial Obligations

Strategizing income allocations between personal needs and business reinvestment is critical for financial stability. Managing personal debts while building a business requires careful planning and prioritization. Achieving work-life balance while ensuring financial stability is a continuous effort that contributes to long-term success.

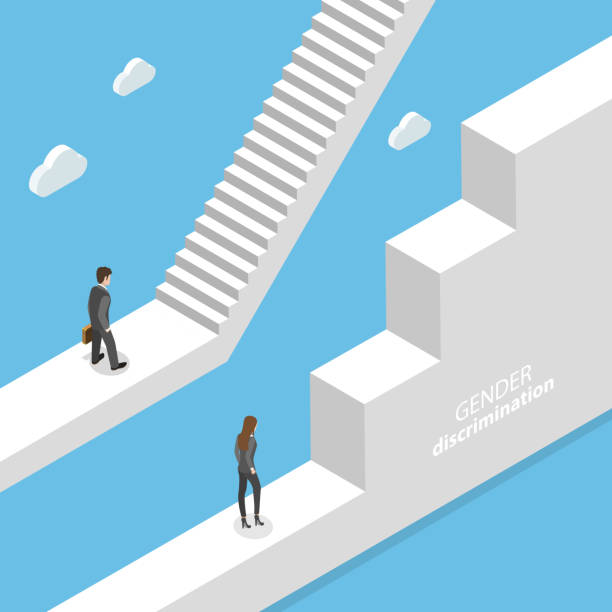

Overcoming Gender Bias and Financial Challenges

Women entrepreneurs must navigate gender-based biases and obstacles prevalent in the entrepreneurial world. Strategies to overcome these challenges include leveraging available resources and networks for support and empowerment. By cultivating a supportive community, women entrepreneurs can thrive and overcome financial hurdles.

Key Takeaway

As you venture into the world of entrepreneurship, remember that financial success is a journey, not a destination. With dedication and the right financial strategies in place, you can achieve your dreams. Trust in your abilities, stay committed to your vision, and remember that you are not alone in this journey. Seek support, knowledge, and mentorship when needed. With the right guidance you can build a solid financial foundation for your business, and you'll be well on your way to entrepreneurial success!

Write, Record and Answer! Consume Unlimited Content! All you need to do is sign in and its absolutely free!

Continue with one click!!By signing up, you agree to our Terms and Conditions and Privacy Policy.