Step-by-Step Guide to File Income Tax Return for FY 22-23

5 minuteRead

It’s that time of the year when every taxpayer has to file his/her income tax. Return filing is a mandatory process that has to be done every year. So, for those unaware, an income tax return is a form that allows a taxpayer to declare his expenses, income, tax deductions, taxes and investments. According to the Income Tax Act 1961, it is mandatory for every taxpayer under various scenarios to file their income tax return. The process is important for multiple reasons such as record maintenance and for future loan perspective. The income tax return last date is 31st October 2023 for all the audit cases and for all the non-audit cases, the due date is 31st July 2023.

Filing IT returns is no longer a hassle as it used to be. Thanks to e-filing, it is convenient to file returns from your home or office.

If you’re someone who is new to the process, let’s take you through our step-by-step guide.

How to File an Income Tax Return?

- The taxpayer should calculate their income as per the different provisions applicable. When calculating income, take into account income from all sources such as salary, interest from income, freelancing etc. TCS, TDS and advance tax paid by them should also be accounted for.

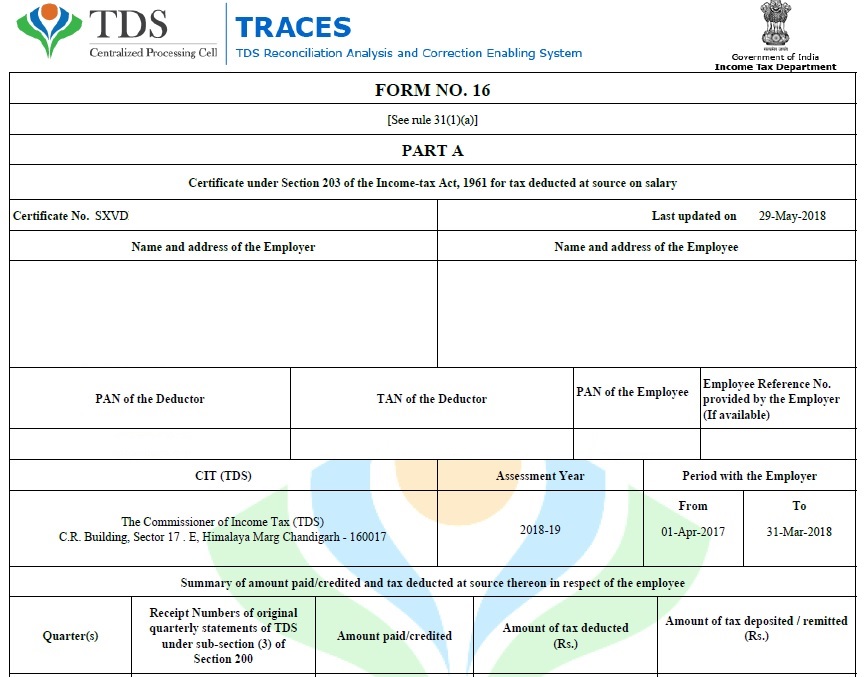

- Even before you begin filing your return, keep certain documents handy. Some of them include PAN, Aadhaar, form 16/16A/16B to fill details of income, bank statement, interest statement of the year, copy of the previous year’s tax return, TDS certificate and form 26AS to cross-check TDS details.

- Before proceeding to file returns, you must ascertain which ITR form fits you. Returns can be filed either offline or online. Although, most people prefer e-filing. Only ITR 1 and ITR 4 are available online. All other forms must be uploaded offline after generating XML.

- Based on your preference, download the utility software. Make sure you choose the relevant assessment year.

- Once you have downloaded the software, follow the instructions and enter all details from your form 16.

- Fill in the relevant details of your income and fill in the tax payable or refunds receivable as per the calculations. You could also use an income tax calculator.

- Once you fill in all the necessary details, make sure you validate them by clicking on the validate button.

- Generate an XML file which automatically gets saved on your computer.

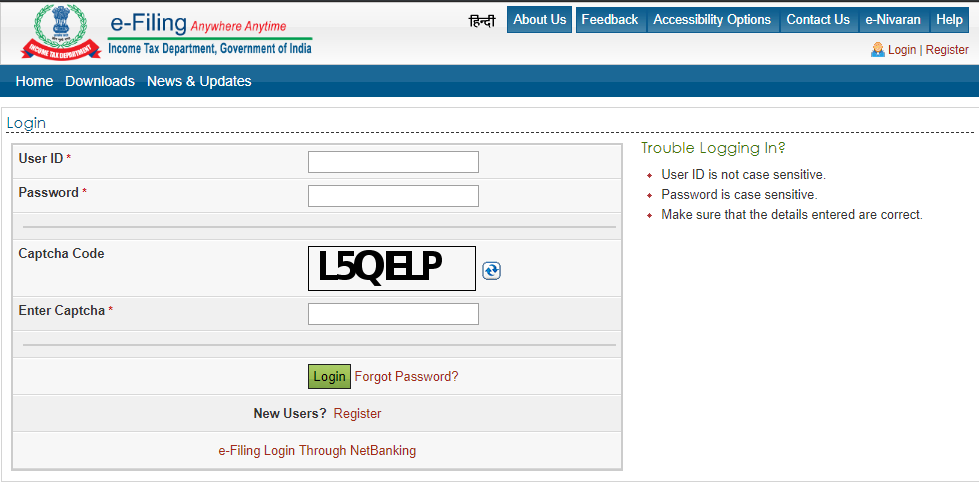

- Login to the income tax e-filing portal and click on the ‘e-file’ tab to select the ‘income tax return’ option.

- Provide the necessary details including PAN, assessment year, ITR form number and the submission mode. Attach the XML file from your computer and click on the submit option. Choose any of the verification modes that suits you – Aadhar OTP or electronic verification code.

- A message confirming successful e-filing is flashed on your screen.

ITR Filing: Changes for FY 22-23 you need to be aware of

Before starting to file your return, here are a few changes you should be aware of:

- Report income from cryptocurrencies and other Virtual Digital Assets (VDA)

From 1st April 2022, specific provisions have been introduced related to VDA incomes. TDS under section 194S is applicable to payments received for crypto transactions. For those who have income from VDA, you cannot file ITR-1 or ITR-4. Instead, the forms for such kinds of income are ITR-2 or ITR-3. The income can be taxed either under business income or capital gains.

- Details of ARN to claim 80G deduction

If you are claiming a deduction under section 80G, it is essential to have a donation receipt and certificate in Form 10BE readily available. Ensure the donation information is entered in the correct table. You will notice that in this year’s ITR form, there is a new column added to “Table D”.

- Report turnover from intraday trading

Though profit or loss from intraday trading is considered speculative, it is subject to taxation under the category of business income and not capital gains. This year’s ITR form includes a specific section called PART-A trading account. Here individuals are required to provide separate information regarding their intraday trading activities.

These are just a few changes made to this year’s ITR. If any of these apply to you, please follow it.

Income Tax Slabs for Women

Income tax in India is considered progressive in nature. In the past, female taxpayers have enjoyed exemptions. However, after 2012-13, things have changed. Since then, a woman’s income is considered equal to a man's. This means, the rate of increase in income tax payable is directly proportional to the increase in an individual’s income, irrespective of their gender. In India, the income tax distribution is divided only on the basis of age and income. Currently, age-wise, there are three types of classification:

- Individuals below 60 years of age.

- Individuals between 60 and 80 years of age (senior citizens)

- Individuals above 80 years of age (super senior citizens)

Now since the categorisation remains the same, here are the tax slabs that are subject to change during each union budget.

Income tax distribution for women below 60 years of age

Income Tax Slab | Rate of Income Tax |

Up to Rs 2,50,000 | Nil |

Rs 2,50,001 to Rs 5,00,000 | 5% above Rs 2,50,000 |

Rs 5,00,001 to Rs 7,50,000 | Rs 12,500 + 10% above Rs 5,00,000 |

Rs 7,50,001 to Rs 10,00,000 | Rs 37,500 + 15% above Rs 7,50,000 |

Rs 10,00,001 to Rs 12,50,000 | Rs 75,000 + 20% above Rs 10,00,000 |

Rs 12,50,001 to Rs 15,00,000 | Rs 1,25,000 + 25% above Rs 12,50,000 |

Above Rs 15,00,000 | Rs 1,87,500 + 30% above Rs 15,00,000 |

Keeping the income tax department informed about your income and taxability will keep you in the good books of the system and law. It will also prevent any blocks to your financial competency. Make sure you follow the income tax rules 2023 and complete the process before the deadline every year.

If you have any more questions related to ITR filing, visit https://eportal.incometax.gov.in/iec/foservices/#/login.

Write, Record and Answer! Consume Unlimited Content! All you need to do is sign in and its absolutely free!

Continue with one click!!By signing up, you agree to our Terms and Conditions and Privacy Policy.