New to Investing? Know what is Nifty50 on Sensex!

4 minuteRead

What is Nifty50 on Sensex?

The National Stock Exchange of India Ltd.'s main index is the NIFTY 50. The index monitors the performance of a portfolio of blue-chip businesses, the biggest and most valuable Indian equities. A fair representation of the Indian stock market, it comprises 50 of the over 1600 firms listed on the NSE, accounting for around 65% of its float-adjusted market capitalization.

The NIFTY 50 offers financial professionals access to the Indian market through coverage of the country's key industries in a single, effective portfolio. Since trading in April 1996, the index has been popular for benchmarking, index funds, and index-based commodities.

NIFTY50 Futures

The NIFTY 50 is the most actively traded index on the F&O section of the NSE and serves as the benchmark for the Indian equities market. NIFTY 50 Futures Index has been created to serve as a benchmark for monitoring the NIFTY 50 Futures contract performance.

Trading in Nifty futures is a typical proxy for trading the market as a whole since the Nifty is fairly indicative of the market is crucial and the economy as a whole. Naturally, you have thought about the economy's status and other considerations when investing in a Nifty future. The minimum lot size for the Nifty is 75 units, making the lot worth slightly over Rs. 7.50 lakhs.

Nifty Futures plays a highly unique function in Indian derivatives trading. Nifty Futures acquires the value it has by itself from any underlying asset. The index itself serves as the underlying securities for Nifty futures contracts. As a result, the Nifty Index is where the value of the Nifty Futures comes from. Thus, the value of the Nifty futures grows with an increase in the price of the Nifty Index.

NIFTY50 Companies

The NIFTY 50 index, which includes 50 well-diversified firms, is an indicator of the state of the market. Using the free float market capitalization approach, the NIFTY 50 Index is calculated.

NIFTY 50 is used for several things, including establishing index funds, ETFs, structured products, and benchmarking fund portfolios. NIFTY50 USD, NIFTY 50 Total Returns Index, and NIFTY50 Dividend Points Index are three different indexes.

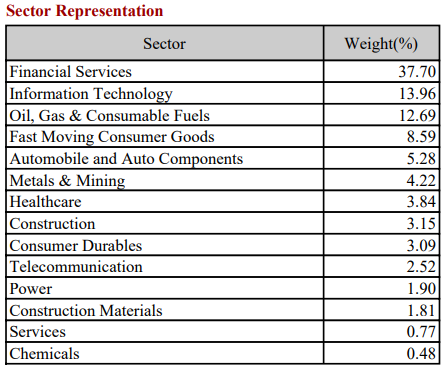

The NSE's diversified index, known as NIFTY 50, consists of equities from the 50 largest Indian firms across 14 sectors. The top firms in 2022 are depicted in the figure below.

How to buy Nifty50?

NIFTY 50 is made up of the best firms in India, and by investing in them, you can own a part of these outstanding companies.

There are two methods for buying NIFTY 50. One is to purchase equities in the same proportion as their weight in the NIFTY 50. The second choice is to invest in index mutual funds that follow the NIFTY 50. These index mutual funds completely replicate the holding of the NIFTY 50. The 50 stocks in a NIFTY 50 index fund will therefore be distributed among them in the same proportion as the NIFTY 50, and all you need to do is to invest desired amount in these funds.

NIFTY50 SELECTION CRITERIA

- Universe

An organization must first be listed on the National Stock Exchange to be considered for the NIFTY 50. (NSE). A company's shares should also be available for trading in the NSE's futures and options market. The company cannot be a member of the NIFTY 50 if it is not declared and traded on the NSE.

- Basic Construct

The top 50 major corporations from the NSE universe are chosen based on their free-float market capitalization. The market capitalization of a firm with higher liquidity is determined by multiplying its stock price by the number of current market shares. For instance, a firm's market capitalization would be Rs. 30 lakhs if it had 1 lakh easily accessible shares in the market for Rs. 30 per share.

- Liquidity (Impact Cost)

Liquidity/Impact cost is the price of carrying out a trade in a security that is weighted by its free-float market capitalization compared to the index free-float market capitalization at any particular time. This is the percentage markup experienced while purchasing or disposing of the required amount of security with its ideal price (best buy + best sell) / 2.

- Rebalancing and Reconstruction

The NIFTY 50 index's top 50 firms change every year. In June and December of each year, the index is rebalanced semi-annually. The NIFTY 50 index eliminates stocks that would have declined in market value or been suspended or removed from the list during the rebalancing process. The deleted supplies are then swapped out by developing stocks whose market capitalization would have grown. The NIFTY 50's allocation to developing companies and sectors automatically increases throughout the rebalancing process.

If a firm launches an IPO and meets the standard eligibility requirements for the index, such as the universe, impact cost, basic construct, market capitalization, and movable stock, for a three-month period rather than a six-month period, it will be eligible to be included in the index.

Stock Substitution from the Index:

In an index, a stock might be removed for the following reasons:

- Mandatory adjustments like match and corporate actions, etc., in this case, the stock with the highest free float market capitalization that satisfies other criteria for liquidity, turnover, and risk-free assets will be considered for inclusion.

- The stock with the greatest free-float market capitalization in the substitution group has at least two times the free-float market capitalization of the index stock with the least free-float market capitalization when a stronger choice is available in the substitution group to replace the index stock.

- A maximum of 10% of the index size (number of stocks in the index) may be altered in a calendar year.

Investing in the NIFTY 50 index allows you to gain exposure to 50 leading organizations. As a result, you significantly increase your chances of building up a massive fortune over time. Investing in the NIFTY 50 index using the index Mutual Funds can also be straightforward, simple, and cost-effective.

Hope you enjoy your trading journey as now you know all about Nifty 50 too!

Write, Record and Answer! Consume Unlimited Content! All you need to do is sign in and its absolutely free!

Continue with one click!!By signing up, you agree to our Terms and Conditions and Privacy Policy.