Financial Planning for Women – All you need to know

5 minuteRead

By Shraddha Mehta

“If you don’t take care of your money, your money won’t take care of you” – Mac Duke, The Strategist.

Life is not a straight - clear - challenge free pathway and there comes a time when everyone faces some form of financial turmoil. Such was the case with the co-founder of AIB, Tanmay Bhat. In a recent podcast, Bhat recalls how during his Boards, his father was laid off and the family struggled to make ends meet. It was essentially his mother who saved the day and sustained the family for the next 6 months with her “secret” savings and investments despite a mediocre paying job at the bank.

Women empowerment is also about financial freedom. Financial knowledge need not be complicated rather it is about guidance from the right people and resources such as Nisary Mahesh, the founder of Hermoneytalks-India's first one-stop women's financial platform. It aims to provide women with financial empowerment by connecting women to financial institutions and experts.

In this video, she explains how can you choose Financial Freedom without getting overwhelmed by financial jargons

Women are an absolute natural at better financial planning than men, reveals a study conducted by the Spectrum Group. They are predisposed to undertake favorable investments and plan better to fulfill financial goals. Over the years, unfortunately, Indian women have had very little to do with the financial decisions of the house thanks to social conditioning and patriarchal traditions.

But now is the time for women to challenge the age-old taboo and take a big leap towards financial inclusion with changing social norms and freedom to earn. And we can finally see this happening around us.

In October 2019, Scripbox surveyed around 400 women (of which 54% millennials, 56% non-millennials) to understand their investment quotient. A majority of 44% of respondents confirmed that they needed financial advisors and are willing to accept additional help in financial planning. Nearly 25% of respondents admitted to not having a financial goal in mind.

Another survey was conducted by Scripbox in February 2020 with over 600 women (of which 70% millennials, 24% GenX, rest over 50 years age) across India to find out how they deal with their earnings. The survey revealed that 68% of the respondents either manage their own finances or had an equal say in family financial decisions. A solid 80% of the women confirmed that they are disciplined with monthly savings, with more than 20% saving nearly half their monthly income.

The surveyed women seem to be going in the right direction as it is highly advised, especially for single women, to save more. The reasons why women need to save more are - gender pay gap, career breaks, and a longer life span. According to the Monster Salary Index Report 2019, women in India earn 19% less than their male counterparts. The gap is more at the executive level at 45%, while the gap is 25%- 30% at entry level. In India, women are more prone to taking career breaks for- taking care of children or sick parents, relocation due to marriage etc. This in turn has a direct impact in form of losses in forced savings like PF, downturn in career progression and foregone investment. As per the Global Health Observatory, female life expectancy on average is 6 to 8 years more than male means more money required to sustain longer life.

Now that we have a little background on the ‘women and finances’ equation, let’s get to the crux of the matter and explore the key ingredients of the below master recipe:

Plan

Warren Buffet, a billionaire American investor and philanthropist advises people to stick by a simple rule - Do not save what is left after spending but spend what is left after saving. The first step towards giving life to his advice in your life and knowing how to manage your money is - to chalk out a plan for money utilisation.

Step 1 – Track cashflow:

Expense tracking makes you cognizant about where you are spending your money instead of wondering where it went. It is important that you record ALL your expenses - even a pencil! Once you have all the data, you can then group your expenses in cost categories like – food, stationery, maintenance to get an overall picture of your purchases.

Step 2 – Set goals:

Setting a saving goal is a stepping stone towards efficient money management as it gives direction to your plan. You can begin with deciding what you want to save for - it could be a dress, a vacation, a home or your child’s education. You can divide your goals into short term – under 1 year, medium – 1 to 3 years and long term – over 4 years. Set easy and achievable short term goals. The resulting small wins will motivate you to align yourself better for the demanding and practical long term goals.

Step 3 – Build budget

Once you are aware of the nature of your expenses and the goals you want to achieve, you can start building a budget to develop a structured road map to reach your goals. Budgeting helps you figure out where your finances stand.

The popular 50/30/20 budget rule is a simple way to budget where you spend 50% of your after-tax pay on needs, 30% on wants, and 20% on savings or paying off debt.

You can tweak this rule as per your circumstances and preference perhaps even come up with a fourth leg to the proportion - Investments. Additionally, Indian women who live with their parents should take advantage of having to spend bare minimum on their necessities and try to save as much as possible.

After you’ve made the income allocation rule that suits you, start building your budget.

- First apportion your income to the savings fund or any other fund (like emergency fund, debt pay off fund, online course fund) you’ve created, as per your rule.

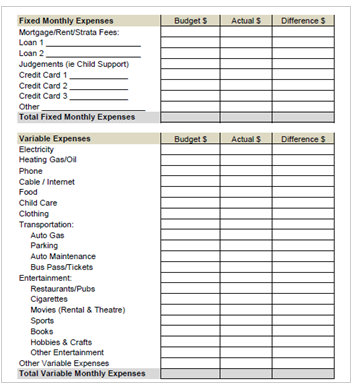

- Then apportion the remaining money to a planned expenses .Classify your cost categories into fixed expenses (rent, EMI, domestic help’s salary) and variable expenses (order in, shopping, fuel) to know which cost are discretionary and non-discretionary.

- Record actual expenses against the planned expense to arrive at the difference.

- The difference recorded in the final column is planned expense – actual expense. The difference can be favourable or unfavourable depending on how much you’ve underspent or overspent. Your aim should be to keep it favourable or your savings will take a hit!

Following is a basic view of a personal budget:

4 – Cut expenses

Tracking your expenses will make you realise that you’ve probably been indulging in lots of impulse buying on Instagram thanks to the Instagram ads while mindless scrolling or you could learn that the most expensive thing you consistently spend on is a ₹380 coffee.

When thinking of cutting down expenses, it usually makes sense to first pay credit card bills on times in order to keep your credit score in check and pay off the debt that charges the highest rate of interest if you have taken any loans and. It is also good to keep in mind that the Indian Income Tax Act allows for various tax deduction and exemptions on interest expenses and/or principal repayment for education loan under section 80E and for home loan under section 80C and 24. However, there are no specific sections mentioning tax benefits on a personal loan.

Then you must focus on if there is anyway fixed expenses could be worked around. This is usually difficult, but you could consider a few following suggestions –

- changing your monthly wifi or mobile plan to a more sustainable one

- cancel expensive subscriptions/memberships to apps and clubs whose services you don’t use often.

- curb the power consumption in your house by – using a programmable thermostat to automatically change temperature at home, lowering the temperature on the water heater so that it doesn’t not have to maintain a store of warm water at a high pocket burning temperatures, utilizing power strips and power timers to turn electrical devices on and off or consider a prepaid electric bill plan. Also try to curtail water bill by using water judiciously.

- moving to a less expensive but safe area for a while and carpooling to work to save on your fixed rent and fuel expenses.

The next thing is to find all the ways you can curb your variable or discretionary spend. This involves a little hard work, the will to put a cap on your desires and the skill to talk yourself out of buying something. Here are a few suggestions you could consider:

- Cook and pack your meals at home. Sometimes you can make extra dinner so that you can use it for lunch the next day.

- Wait it out and only buy the big items like fridge, laptop, washing machine when there is a sale going on. Always ask for any discounts/offers wherever you shop. At the same time be aware to not blow yourself out at a sale unnecessarily.

- Spend smart, for example – buy a combined Netflix plan with friends rather than paying for an expensive single subscription, compute the cost-effectiveness of zero interest EMIs by looking at hidden costs like processing fees.

- Checking your bank balance regularly will give you regular reality checks instead of a shock at the end of the month. And spending in cash will make you more mindful and keep you in control of your finances.

- Leave the item for 24 hours before making the purchase. If you are still thinking about it the next day and can afford it, then you could go ahead and buy it.

- Change your surrounding that makes you spend. Mute certain pages on social media that have too much-promoted content, avoid a few party nights and try to channel your energy and time in productive things.

Finally, if you are about to spend more than 10% of your monthly salary on a single item then ask your self these questions:

- Can I live without it?

- Based on my financial situation, can I afford it?

- Will I actually use it?

- Do I have the space for it?

- What is my emotional state in general today? (Calm? Stressed?)

- How do I feel about buying it? (Happy? And how long will this feeling last?)

Step 5 – Review

In the last step, at the end of each month you must look back and reflect on your progress. Revisit your plan to incorporate any changes in the future and update your goals every few months. Repeat Step 2 to Step 5.

Kakeibo

At this point, I would like to introduce you to Kakeibo ( translates to household financial ledger), a Japanese method of saving money. It is more or less the same as the above steps that we discussed, but what sets it apart is that it doesn’t have any technology involved - only a notebook and a pen. It emphasizes the importance of writing things down. When financial goals are penned down, they become more concrete. Statistics show that people who put their goals in writing have an 80 percent chance of achieving them.

What is more important about the Kakeibo technique is that it places immense emphasis on mindful spending and incremental changes. It makes you to think about your purchases and what motivates you to buy them and makes you honest about your needs and wants. In short, it induces awareness and discipline in handling money. Most of the above suggestions to curb variable expenditure and the questions you must ask yourself before making a big purchase are inspired by the fundamentals of Kakeibo. This method is for you if being tech-savvy is not your cup of tea!

Save

“A penny saved is a penny earned” – Benjamin Franklin.

Any act that is done consistently shapes our life and so is the case with savings. It is vital that you are consistent with your savings even if your brain is tricked by YOLO or FOMO. Thankfully, there are plenty of options where you can safeguard your money and even multiply it.

Savings account – This type of account allows the holder to deposit money at her convenience and even earn interest of 4% - 6% on the same. It is best suitable for folks with a steady income and short-term financial goals. There is usually a limit to the number of transactions permitted per month and a minimum balance to be maintained in some accounts.

Banks like ICICI, HDFC and Axis have special women’s savings account and offer various benefits like – personal accident insurance cover, a cashback per month on the usage of debit cards across key segments, 50% discount on locker rentals and processing fees on loans, unlimited free transactions. Few banks also offer zero balance

Fixed Deposits – These are popular saving vehicles for the long term with the highest maturity period up to 10 years. FDs comparatively offers higher interest rates of 6.25% to 8% than savings account where your money is locked in for a fixed tenure and premature withdrawals are not allowed. Although you can break the FD in case of emergency by paying a penalty

Banks also provide a Sweep-in facility on term deposits, that interlink the depositor's savings bank account with a fixed deposit account. This facilitates the auto-transfer of surplus amount from savings account to the FD account and earns FD rates on your savings account. The other benefit is that FD will automatically be broken by the bank in order to fulfill transactions for which there are not enough funds in your account without affecting the full deposit amount or the interest on it.

Bajaj FinServ, an NBFC, rated FAAA by CRISIL offers a lucrative interest rate of up to 7.60%, which can go up to 7.85% for senior citizens with a minimum deposit of ₹25000. It offers various benefits like – loan against FD up to 75% of FD value, flexible tenors between 12 to 60 months.

– These are the flexible versions of Fixed deposit where the account holder can make regular deposits. The period of the deposit and the amount to be deposited regularly can be chosen by you. Most banks calculate interest on RD quarterly and offer high rates of 6% to 7%. Rates that are once decided for a tenure, remain fixed and don’t change during the tenure. Just like FDs, premature withdrawal is allowed by paying penalty.

Endowment Plan - Endowment plan is a life insurance policy which offers both - an insurance cover and a savings plan. You pay a higher premium compared to a conventional life insurance policy since you get best of both worlds. The premiums you pay are essentially periodic savings for a stipulated time period of 10, 15 or 20 years at the end of which (i.e. when policy matures) you receive a promised lumpsum. However, in case of sudden death of the policyholder, the insurance company will pay the sum assured to the nominee of the policy. Some policies also pay out in the case of critical illness.

There are different types of endowment plans: Unit Linked Endowment holds units of insurance premiums under specific investment funds chosen by policy holders and gives out amount along with earnings from the fund attributable to the policy holder. With Profit Endowment gives out the assured amount along with bonuses that are announced from time to time by the company. There is also Non-Profit Endowment with no extra bonus or profits. Unlike normal life insurance policies, under endowment plans you don’t have through any medical check-up.

Voluntary Provident Fund – Every month a certain amount of money is deducted from an Indian employee’s salary as PF (provident fund). This is done for the Employee Provident Fund (EPF), a retirement savings scheme mandated by the government where a minimum of 12% of the basic salary is deposited in the EPF account. For a woman employee on her first job, the EPF contribution is capped at 8%.

Now, the Voluntary Provident Fund is the contributions made by the employees that are beyond the minimum contribution to their EPF, to earn returns. The current interest offered on VPF contributions is 8.65%.

To make a VPF contribution, all you need to do is inform your employer that you want to increase your EPF contribution. The employer will then deduct the sum that you wish to invest as VPF from your salary. This is a risk-free way of saving money as it is back by the government and this fund can also be transferred across all eligible employers.

Public Provident Fund –PPF is a tax-free savings scheme that earns an annual interest where the government revises the rate every quarter. The minimum annual contribution that can be made to a PPF account is Rs. 500 while the maximum is capped at Rs. 1.5 lakh. There can only be 12 contributions per year. The lock-in period is 15 years, although one partial withdrawal per year is available after the 5th year or 7th year (which is tax-free) depending on your bank and a loan can be availed against the PPF from the 3rd to the 6th year.

National Savings Certificate – Just like PPF, NSC is also a fixed income investment scheme that can be accessed at any post office. This scheme is for Indian “individuals” only and offers guaranteed interest and capital protection. The certificate earns an annual fixed interest rate, currently, 7.8% and this rate is revised by the government every quarter. The interest earned is compounded annually ad reinvested by default. The minimum amount required for the certificate is ₹100 with no maximum limit, but the maximum tenure is for 5 years only. NSC certificates are accepted as collateral or security for secured loans in Banks and NBFCs.

Sukanya Samriddhi Account - You can save in this scheme only if you have a girl child. The account can be opened for a maximum of two girl children any time after their birth till they turn 10. The current rate of interest is 8.4% which is revised every quarter and compounded annually. The minimum annual deposit is ₹250 and the maximum is ₹1.5 lakh. The amount must be deposited in this account for 15 years but the account matures after 21 years or whenever the girl gets married whichever is earlier. This means that there are no deposits between the 16th and 21st year.

And the final good news of this section is that all the above-listed savings options are eligible for tax deductions under Section 80C of Income Tax Act 1961 up to ₹1.5 lakh. Endowment plans are eligible to further benefits under Section 10(10D). But the Fixed and Recurring Deposits are eligible for tax rebate under section 80C if held for a minimum of 5 years although the interest earned on these deposits is taxable.

Invest

Investment is the last element of our financial stability equation. Aya Laraya, a certified securities representative says “When you invest you are buying a day you don’t have to work”.

Investment is not as straight forward as the act of saving, it means putting your money out there and exposing it to risk of market fluctuations. Your investments will grow and be secure if you have - a) patience b) understanding of your risk appetite (i.e. willingness to tolerate loss of investment) and c) market knowledge.

Let us understand what a mutual fund is. A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities. It gives individual investors access to diversified, professionally managed portfolios at a low price. A mutual fund thrives on the idea of not keeping all the eggs in one basket. Investors typically earn a return from a mutual fund through:

- Distribution of income that the fund makes via dividends on stock and interests on bonds.

- Distribution of capital gain that fund has by selling securities whose prices have increased.

- Selling their own share of the mutual fund in the market.

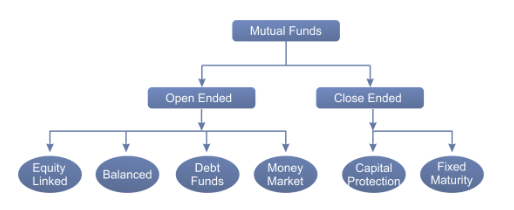

Below are the types of mutual funds and their make. Open-ended mutual funds are available for subscription throughout the year whereas close-ended mutual funds have a lock-in period and a maturity date.

Some of the investment options that are related to mutual funds are:

Systematic Investment Plan - SIP is an investment route where one can invest fixed small amounts r weekly, monthly, and quarterly in a chosen mutual fund scheme. A minimum of ₹500 can be invested in mutual funds in India. SIP offers various flexibilities in terms of investing such as withdrawing amount at regular intervals and transferring funds from one mutual fund scheme to another

Equity Linked Savings Scheme – ELSS are tax saving mutual funds that mainly invest in equities. They have a lock-in period of 3 years. These funds give high returns if you stay invested for a longer time period. Qualifies for tax exemption of ₹1.5 lakh under Section 80C.

National Pension System –NPS is a scheme initiated by the Indian government seeking to provide retirement benefits. A subscriber can contribute regularly in a pension account during her working life, the pension fund grows until retirement via contributions and market-linked returns. On retirement or exit of the subscriber at least 40% of the contribution is utilised for the procurement of lifetime pension via the purchase of an annuity. The remaining funds are paid to the subscriber in a lump sum.

Moving on from mutual funds, following are the main platforms and items you could consider putting your money in:

Secondary Market- This is where you can trade - stocks, bonds, commodities, futures, options, and various other individual financial instruments. You can open a DEMAT account online and start trading on exchanges like NIFTY, BSE, MCX and so on. It is highly recommended to get a financial advisor before venturing into the market. Most people blindly invest in financial instruments based on random tips by peers or self-proclaimed experts that lead them towards financial ruin.

Gold – This is the oldest method of investing your money which running in Indian households from generations. Fun fact – the value of gold in 1990 was ₹3200 per 10gm and now in 2020, it is around ₹49500 per 10gm. Therefore, investing in gold is a golden option that will not disappoint.

Gold investment can be done in many forms like buying jewelry, bars, gold exchange-traded funds, gold funds, sovereign gold bond schemes and so on.

Gold ETFs(Exchanged Traded Funds) is similar to buying physical where the gold bought is stored in Demat (paper) format instead of going through the hassle of storing it physically. On the other hand, in gold funds investment is done in the form of gold bars in gold mining companies.

Sovereign gold bonds are issued by the Reserve Bank of India in the form of digital gold offering an interest of 2.5% with a lock-in period of 8 years. The bonds are denominated in units of grams of gold with a basic unit of 1 gram. The maximum investment one can make is 4 kg. These bonds have an exit option from the 5th year onwards.

Coming to the last segment of this blog. Here are some of the top-rated apps in India that could help you with planning, saving and investing your money – Qykly, Walnut, Chillr, Wally, Clarity Money,ETmoney and the free app Mint. Appealing features of some of these apps are –

- Expense tracking and ability to analyze expense and income graph

- Automated bill payments and reminders

- Bill splitting facility amongst your group

- Enables tax-saving and reimbursement categorization

- Provisions investment in mutual funds and other savings account schemes

- Ability to analyze existing investments

- Generates transaction summary on a monthly basis

Conclusion

Managing finances may not be easy but it is no rocket science either. Simple changes in your lifestyle can help you save more. Plus, with plenty of support and information available on the internet from banks, government bodies, investment platforms and trusted websites, one can create a win-win situation between current spendings and future savings.

FAQs-

Q1. Why is finance planning for women important?

Finance planning for women is extremely important as it will not only help them cut down on the financial dependency on either their partners or their families but will help them fulfill their financial goals.

Q2. Some of the best financial tips for women?

Financial planning can be done very easily by applying some of the following and effective tips-

- Track your cash flow

- Set your goals

- Build a budget

- Cut down on extra expenses

- Review and save

Q3. Some of the best women financial advisors in India?

Some of the best women financial advisors who can help you invest and save your money to reach your financial goals are-

- Shilpa Maheshwari

- Shivani Bhasin Sachdeva

- Supriya Rathi

Disclaimer: The author and publisher of Glo.community have used their best efforts in preparing the article. They make no representation or warranties with respect to the accuracy, applicability, fitness, or completeness of the contents of this article. The information contained in the article is strictly for educational purposes and we do not endorse any product mentioned in the article. Therefore, if you wish to apply ideas contained in the article, you are taking full responsibility for your actions.

Write, Record and Answer! Consume Unlimited Content! All you need to do is sign in and its absolutely free!

Continue with one click!!By signing up, you agree to our Terms and Conditions and Privacy Policy.